You can use your amplify points to pay for your card's annual fee. 3 days and 5 hours ago:

Pdf Information And Communication Technologies For Direct Poverty Alleviation Costs And Benefits

George bank’s rental vehicle excess insurance, which covers up to $5,500 for any excess or deductible which the.

St george amplify car rental insurance. This will give your points a value of 0.55 cent per point. You'll earn an additional 10% of the points earned in the last 12 months. George airport (gnd) (7 days) compact:

Select cardholders may be able to take advantage of st. Save with $0 annual fee for the first year and up to 55 interest free days on purchases. If frequent flyer points are your goal, the st.george amplify signature card with.

2 days and 9 hours ago: St.george bank will provide accountholders with details of any replacement cover. The st.george amplify signature visa also has a qantas rewards variant that earns 0.75 qantas points per $ on spend.

Select cardholders may be able to take advantage of st. Awp australia pty ltd abn 52 097 227 177 afsl 245631, trading as allianz global assistance (aga), under a binder from the insurer, allianz australia insurance limited abn 15 000 122 850 afsl 234708 (allianz), has issued an insurance group policy to westpac banking corporation abn 33 007 457 141 afsl and australian credit licence 233714 (westpac) which allows. The complimentary insurance benefits are only available to cardholders of the following eligible st.george bank credit card accounts:

They’ll also have to be travelling with you for the duration of the trip. Ad compare low rates from top brands. Carrentals.com offers you the best short and long term city car rental deals from over 55 car rental companies.

Unexpected cancellation of travel arrangements or any other unforeseen expenses; George bank’s rental vehicle excess insurance, which covers up to $5,500 for any excess or deductible which the. Access to interstate flight inconvenience insurance and rental vehicle excess in australia cover, up to 6 months’ complimentary cover for international travel insurance, plus extended warranty, purchase protection for up to 4 months’ and overseas transit accident insurance.

The amplify signature card offers domestic rental vehicle excess insurance of up to $5,500. Book & save big on car rentals. Complimentary purchase security insurance may be available to level 1 cardholders for four months and three months of complimentary insurance accessed by level 2 cardholders.

Rewarding new cardholders with up to 200,000 bonus amplify points over 2 years and an uncapped earn rate of 1.5 amplify points per $1, the st.george amplify signature credit card is a rewards card that offers flexibility and value, delivering appealing extras and benefits such as 0% p.a. This type of insurance covers loss, theft, and damage costs to eligible products. George airport (gnd) (8 days) economy:

Signature card • amplify signature credit card platinum cards Otherwise, earn rate is 1.5 amplify rewards points per dollar on eligible purchases on the amplify rewards variant. If your car is stolen, the insurer will arrange for you to be provided with a rental car for a maximum of 30 days up to $100 per day, if we have accepted your claim.

With the basics covered, it’s time to dig a little deeper into what’s on offer with the st.george amplify signature credit card, so you can decide whether this card is right for you. Also thrown in is extended warranty cover, purchase and price guarantees on eligible purchases, interstate flight inconvenience insurance, transit accident insurance and rental vehicle excess insurance in australia. With a card fee of just $99 (or $49 first year for amplify), cardholders able to travel overseas even one or twice a year (once borders reopen) and who qualify for the inclusive travel insurance package could quickly find the.

Cover is activated you pay for the rental car with your card. For 24 months on balance transfers, complimentary travel insurance, membership to visa’s luxury hotel. This document contains your st.george credit cards complimentary insurance benefits.

Loss or damage to rental vehicles; Allianz provide cover for trips of up to six months for st.george amplify signature customers, while amplify platinum cardholders are eligible. See if it's worth it here.

Book & save big on car rentals. We cover the details of the amplify rewards and its frequent flyer transfer partners in a separate guide. George airport (gnd) (3 days) economy:

You can redeem amplify points towards a wide selection of merchandise through the amplify rewards portal. Ad compare low rates from top brands. St.george's amplify signature offers up to 200,000 bonus amplify points over 2 years, lounge passes and complimentary insurance.

George amplify signature card features a handful of benefits including priority pass visits, travel insurance, and birthday bonus points annually. George's car rental from as low as. St.george amplify business rewards credit card.

Pdf Where Did The Risk Go How Misapplied Bond Ratings Cause Mortgage Backed Securities And Collateralized Debt Obligation Market Disruptions

Cover Ijbe - University Of The Thai Chamber Of Commerce

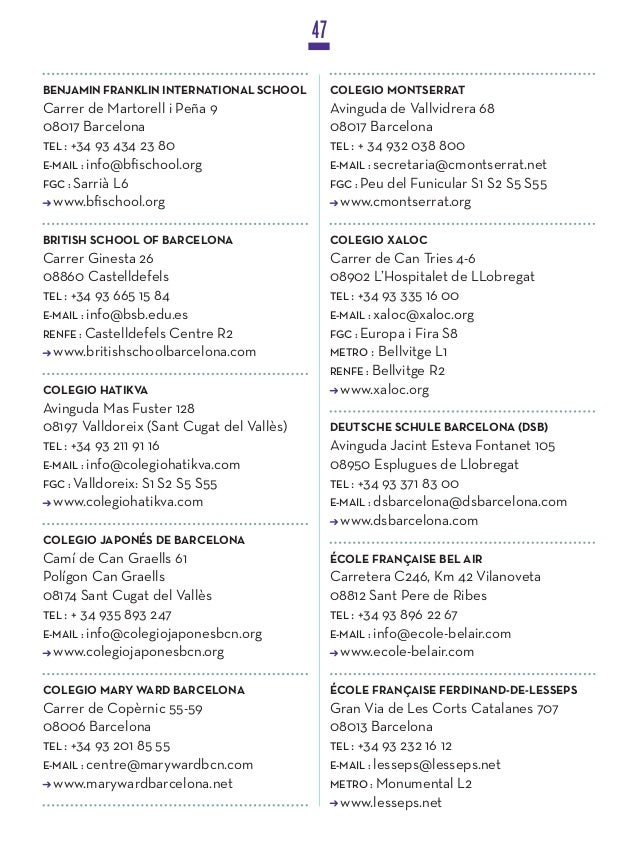

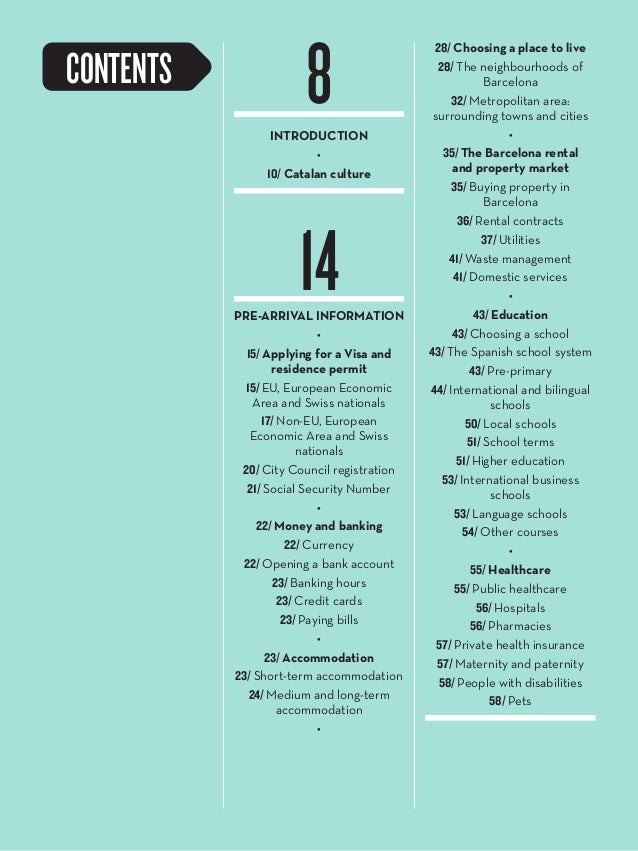

Welcome To Barcelona

Charitable Traveller Magazine - Junejuly 2021 - Issue 5 By Charitable Traveller Magazine - Issuu

Sec Filing Iqiyi Inc

Bank Of Melbourne Amplify Signature Visa Qantas Rewards - Point Hacks

Bulletin For The Youth League To Be Held In Jesolo Venice Italy Fro

Radon Dwi K Himatika Fst Uin Jakarta

Bank Of Melbourne Amplify Signature Visa Qantas Rewards - Point Hacks

Bank Of Melbourne Amplify Signature Visa Qantas Rewards - Point Hacks

2

Anz Rewards Hopes To Reinstate Velocity Points Transfers Soon

Pdf Dna Detective A Review Of Molecular Approaches To Wildlife Forensics

Welcome To Barcelona

2

Overdrawing Your Account

Bank Of Melbourne Amplify Signature Visa Qantas Rewards - Point Hacks

Welcome To Barcelona

Welcome To Barcelona